After the dissolution of a marriage, people may face certain financial difficulties, as they now need to learn how to properly plan their budget. Divorce can also affect those people who are planning for retirement.

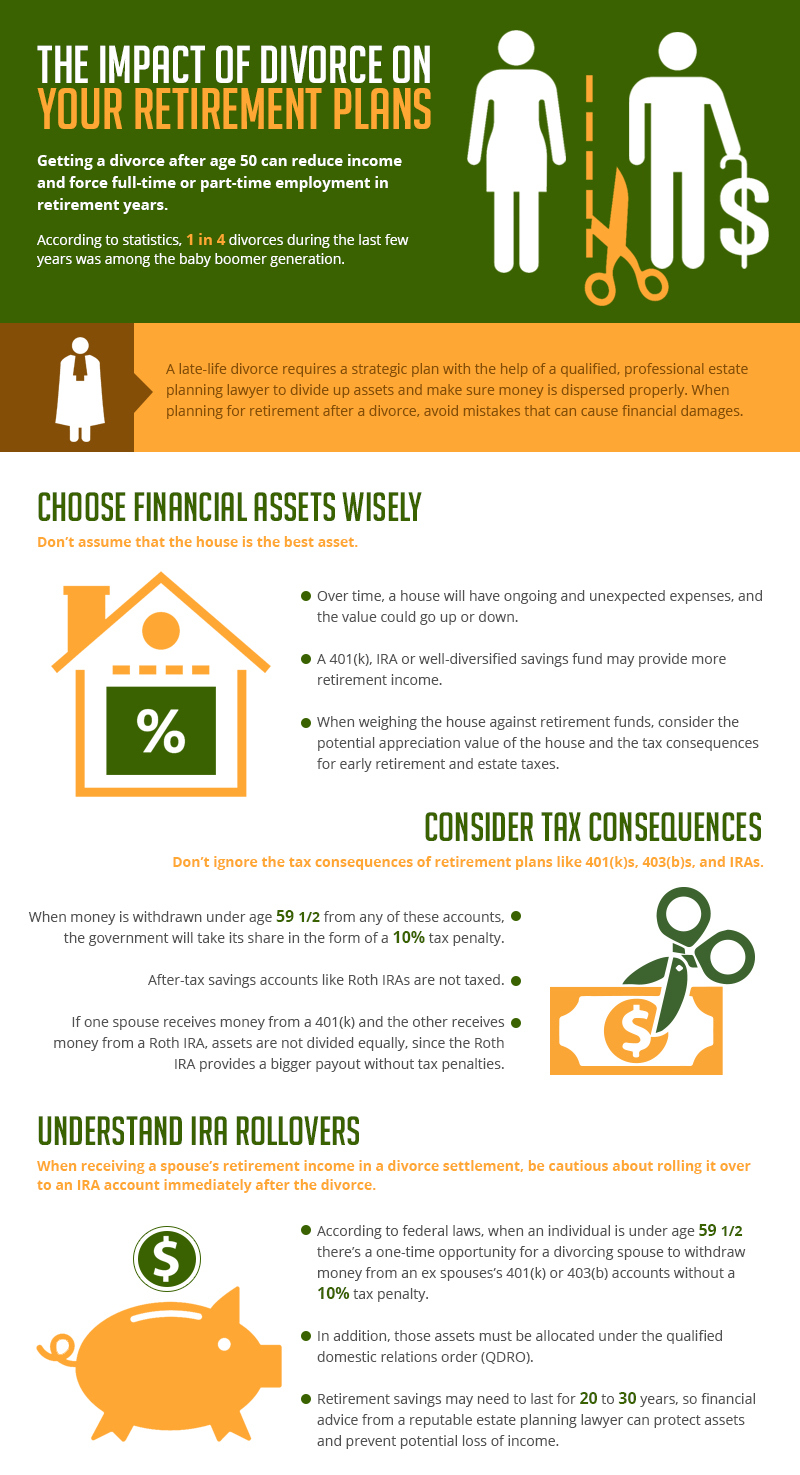

Infographic on the impact of divorce on your retirement plans

Reassessment of pension goals and plans

As a result of the division of common property during the divorce proceedings, the persons involved in the divorce need to reconsider their retirement goals and plans. People may need to adjust their expectations about when they can retire or how much they can save. They may also need to consider alternative sources of income or find ways to cut costs so they can continue to save money to meet their long-term financial goals.

People should review all documents on joint property that were acquired during the marriage. If the partners had joint accounts and other shared finances, it’s important to make sure everything is updated and segregated accordingly after the divorce.

Reassessing your retirement plans and goals is critical when going through a divorce process, as it helps you to objectively assess your financial situation. In this way, couples who are separating can protect themselves financially both now and in the future. Each party will have enough resources necessary for a successful independent life after the divorce procedure.

Impact on Social Security Benefits

By knowing how the divorce process affects Social Security benefits, all parties will be aware of their rights under federal law. This will allow you to make informed decisions about when to apply for these benefits.

Divorce and retirement planning requires careful consideration of various factors, such as:

- reassessment of long-term goals and plans;

- understanding the implications of changes to property planning documents;

- appropriate updating of accounts after divorce;

- assessment of the right to social security after divorce, etc.

It is very important to always seek advice from professionals specializing in financial law regarding the division of property resulting from a divorce.

Valuation of the division of property

Coping with divorce involves many complex financial issues that require careful attention and planning:

- reassessment of pension goals and plans;

- understanding the implications of changes to property planning documents;

- appropriate updating of accounts after divorce;

- assessment of eligibility for social security after divorce;

- assessing property division options, taking into account the tax implications, can provide long-term financial stability even after the completion of the divorce proceedings.

Seeking professional advice from financial experts ensures that people have access to the support they need during this difficult transition.

Related Posts

Updating Documents

During divorce proceedings, people may need to review their financial plans to make sure they accurately reflect their current wishes. For example, if a person listed their ex-spouse as the primary beneficiary of a life insurance policy or retirement account prior to divorce, it is important to update this information after the divorce is completed.

Failure to update property planning documents can lead to unforeseen consequences. Beneficiaries listed in outdated plans may receive benefits intended for a completely different person, which can lead to serious conflicts between family members at an already difficult time.

Updating documents can seem like a daunting task during this difficult period. It is very important to get proper guidance from financial experts who specialize in helping clients resolve property issues arising from the end of a marriage, while also considering the tax implications for both parties.

Before we go to the next unit about finances, take a look at these statistics:

Accounting for the cost of living alone in retirement

One option that can help reduce the financial burden of divorce proceedings is a cheap divorce in California online. This method can provide an affordable alternative to traditional legal services while providing professional guidance throughout the process. By minimizing legal and divorce costs, you can direct your resources toward your long-term financial goals, such as saving for retirement.

Regardless of which method of divorce is chosen, it is important not to lose sight of its impact of divorce on retirement and future finances. Careful consideration of property division options, tax implications, and evaluation of cost-saving measures such as online divorce ensures that people come out of this transition financially secure. Seeking the advice of professionals specializing in financial law provides invaluable support to people during this difficult period, protecting their long-term interests at every turn.

Seeking professional financial advice

Financial planners can provide advice on managing assets, including retirement accounts and investments, after a divorce. They can also advise on the tax implications of dividing property in a divorce proceeding and help create a long-term budget.

This helps to minimize the risks associated with making important financial decisions. This proactive approach protects future sources of income, as well as ensures that all parties are aware of their options when it comes to repaying debts or equitably dividing joint property. Turning to experts makes a huge difference financially and prevents costly mistakes made after a divorce.